Forms and Precedents + Essentials

This webinar introduces and explains how to access, download and use Forms and Precedents in Westlaw Australia and provides an overview of content included in the Essentials package. More dates

This webinar introduces and explains how to access, download and use Forms and Precedents in Westlaw Australia and provides an overview of content included in the Essentials package. More dates

Learn how to find and use the Cases Advanced template to conduct searches across cases. Learn how to maximise Westlaw’s Boolean terms and connectors when using the template. More dates

Learn how to find and use the Cases Advanced template to conduct searches across cases. Learn how to maximise Westlaw’s Boolean terms and connectors when using the template. More dates

Legal update, Australian Information Commissioner commences civil penalty proceedings against Australian Clinical Labs following data breach from cyber attack provides a brief overview of proceedings filed against Australian Clinical Labs (ACL) that allege ACL's privacy practices in...

The guide below will also resolve the validation error, CMN.ATO.GEN.XML04 - A mandatory field has not been completed.

The element 'ExemptForeignIncome' in namespace...

When claiming foreign source income and foreign assets or property at item 20, you must complete:

Please note, you need to create a separate worksheet for different sources of foreign source income.

If you need to report Employment income - non PAYG then,

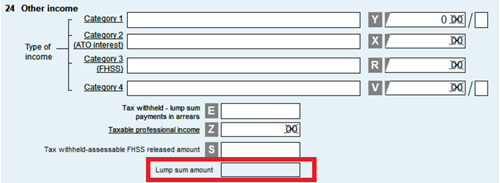

Firstly, check the ATO's prefill did not import data into the item 24 category 1 worksheet for lump sum payment. If it did, please delete the worksheet.

Complete the two lump sum fields in the income worksheet (item 1 worksheet).

• Lump sum code

• Lump sum amount - lum sum year and lump sum amount

The lump sum amount will automatically transfer to the newly added item 24 lump sum amount field. The software will also include $0 at item 24 category 1 to pass validation due to the new validation rules in the 2020 tax return.

On item 7 worksheet, leave the type blank to be able to manually enter the tax offset at item T2.

Additionally, you can create a new line on the item 7 worksheet and skip to the offset column to enter the amount.

If you are receiving an error stating "All Licenses used" upon registering Software Assistant on various machines, it could mean that Software Assistant is registered on more computers than what was purchased.

If you have exceeded the license number you paid for, please call our sales staff who will be happy to discuss the discounted pricing structure of an extra license. 1800 074 333 (select sales) or contact your client manager directly.

If you have not exceeded the license number, please call or email support who will work through the issue with you.

This webinar shows how to carry out media searches using Newsroom. More dates

This session will focus on locating and researching Legislation. It will highlight the benefit of using KeyCite to locate relevant Cases and Secondary Sources that cite or discuss a section of Legislation. Searching techniques will be covered to help efficiently find relevant...