Can't find an answer to your question?

Contact our support team.

Software Assistant

Thomson Reuters Training & Support

Guides & Tips

Browse the library of user guides, support articles, tips and video tutorials to help you get the most out of your solution. Keep visiting this page for new tools and resources.

Webinar: Software Assistant Tax Changes 2025 Full

Webinar: Software Assistant Tax Changes 2025 Full

Trust Income Schedule

Updated information regarding the new Trust Income Schedule (TIS)

Webinar: Software Assistant Tax Changes 2024 Full

Software Assistant 2024 Tax Changes Webinar

Error: 1722 when trying to update

-

Ensure Assistant is closed on all computers (if you have Practice Assistant, please check the Diary is not opened in the background)

-

If you have an antivirus on your computer, please temporarily switch it off. You can do this by right...

How to enter Australian Annuities and Superannuation Income Stream at Item 7

Error: CMN.ATO.GEN.XML01 - The message did not pass XML validation. Please contact your software provider.

The element 'AnnuitiesAndSuperannuation' in namespace...; or

Error: CMN.ATO.GEN.XML04 - A mandatory field has not been completed.

The element...

How do I claim exempt foreign employment income

Complete the following fields in the item 20 worksheet:

- Details of the foreign source income

- Country

- Exempt foreign employment income

- Exempt foreign income tax paid

- During the year did taxpayer own, or have an interest in, assets located...

How do I enter foreign rent

Complete the following fields in the item 20 worksheet:

- Details of the foreign source income

- Assessable foreign source income label E - refer to the ATO's instructions and worksheet, CLICK HERE

- Exempt foreign employment income (enter $0 if there...

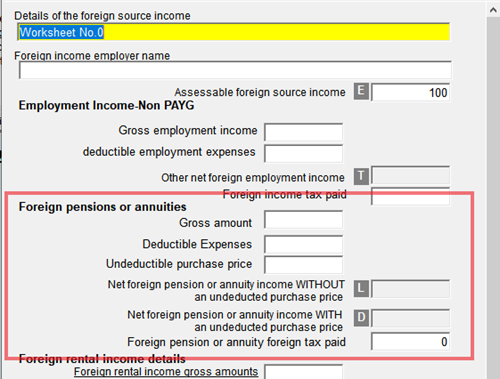

Validation - CMN.ATO.IITR.730355 - Foreign pension or annuity income details are incomplete

This error will appear if the Foreign pension or annuity income at item 20 is incomplete. Firstly, open the item 20 worksheet and check the Foreign pensions or annuities fields:

If the taxpayer did not have any Foreign pensions or annuities then...

How do I enter foreign pensions or annuities

To claim foreign pensions or annuities using the item 20 worksheet, you will need:

- Details of the foreign source income.

- Assessable foreign source income.

- Exempt foreign employment income (enter $0 if there is nothing to report).

- Foreign...

How do I enter foreign source income

The guide below will also resolve the validation error, CMN.ATO.GEN.XML04 - A mandatory field has not been completed.

The element 'ExemptForeignIncome' in namespace...

When claiming foreign source income and foreign assets or property at item 20...

How do I claim lump sum E on 2020 and later individual tax returns

Firstly, check the ATO's prefill did not import data into the item 24 category 1 worksheet for lump sum payment. If it did, please delete the worksheet.

Complete the two lump sum fields in the income worksheet (item 1 worksheet).

• Lump sum code

...